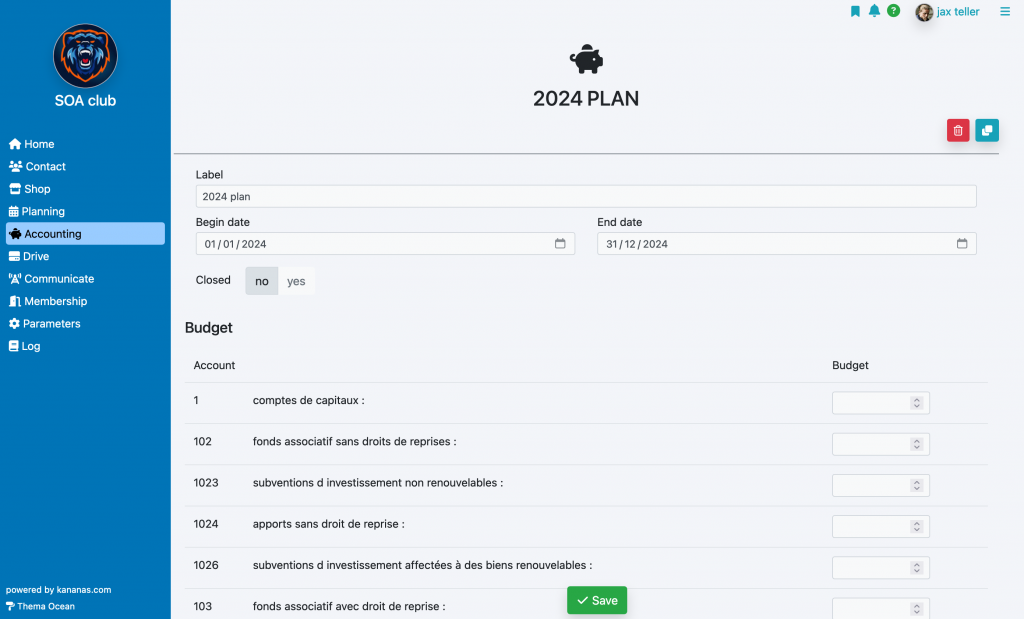

Fiscal year

When you register, the accounting year corresponding to the current year (January 1 – December 31) is automatically created. If you want to modify the exercise or create another one, go to the “exercise” section.

The exercise will be used in certain parts of the application, it will be used to filter the different displays: purchases, revenue/expenses, alerts, activities etc.

Budgets

To define your annual budget, use the fiscal year settings and enter the amounts you allocate per account.

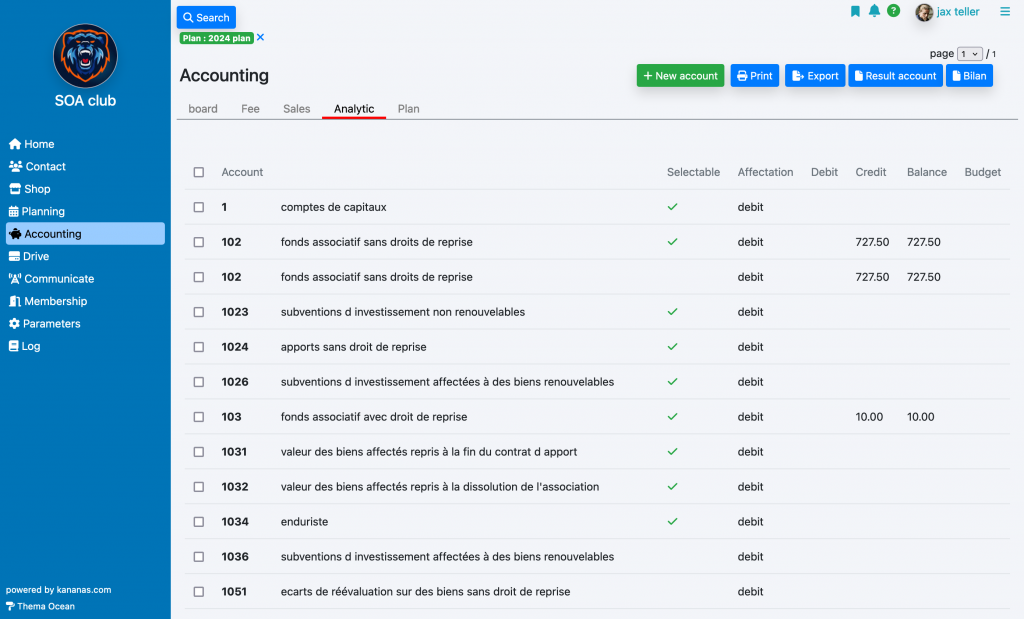

The analytical tab of the « Finances » section will then allow you to monitor the achievement of this budget.

Income statements and balance sheet accounts

The accounts used on the balance sheets and income statements are configured at the account level: finance/analytics menu, then click on an account.

For each account you can choose whether it will be used for the balance sheet (assets or liabilities) or the income statement (expense or income) and whether a budget can be assigned to it.

The “selectable” option allows you to define whether this account can be used when allocating revenue/expenses.

The accounting plan offered as standard is the French associative accounting plan, however the flexibility of the settings allows you to adapt it to the legislation of your country.

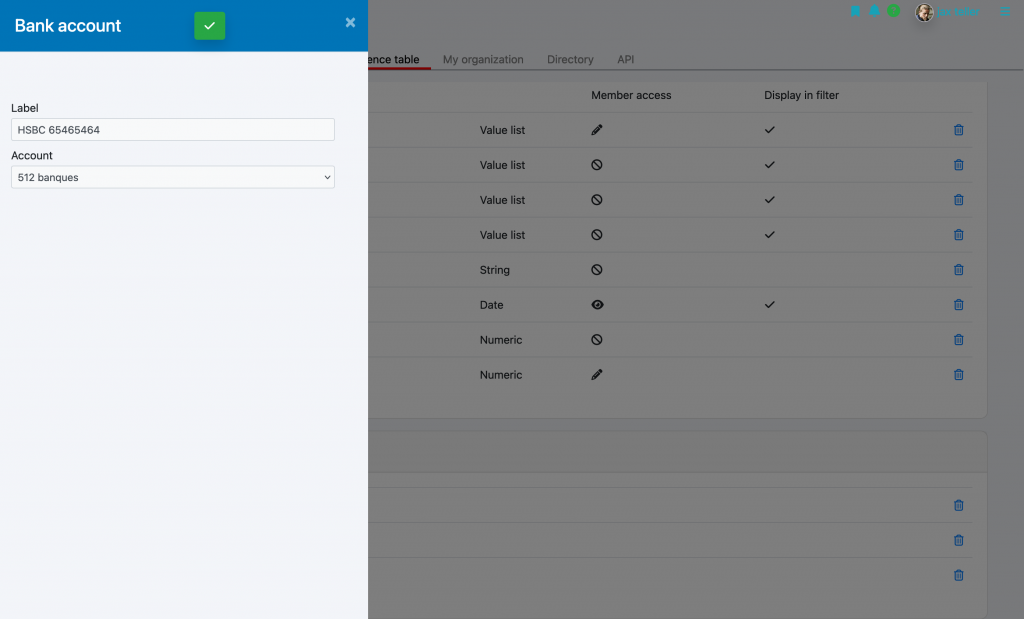

Cash and bank accounts

By default, you have a cash account and a bank account. To create others use the add button in the settings/repository menu then cash/bank account block. This parameter will be included in the breakdown field of an operation.

Accounting by category

In addition to the chart of accounts, you can define revenue/expense categories in order to carry out analytical monitoring of your accounting. To add an analytical category, do “add revenue/expense category” in the “configuration/reference” menu.

To learn more about accounting